FINANCE

Maximize Your Savings: How GoMyFinance.com Helps You Save Money Effortlessly

Are you tired of watching your hard-earned money slip through your fingers? Managing finances can feel overwhelming, but it doesn’t have to be. Enter GoMyFinance.com—a game-changing platform designed to help you save effortlessly and take control of your financial future. With its user-friendly interface and innovative tools, saving money has never been easier or more accessible. Whether you’re looking to build an emergency fund, plan for a vacation, or just want some extra cash in your pocket each month, GoMyFinance.com is here to help make those dreams a reality. Let’s dive into how this remarkable website can transform the way you manage your savings!

Features and Benefits of GoMyFinance.com the Website

GoMyFinance.com offers a user-friendly interface that makes navigating your financial goals simple. You’ll find an array of tools designed to help you track expenses, set budgets, and monitor savings effortlessly.

One standout feature is the real-time expense tracker. It allows users to log purchases directly from their mobile devices. This ensures you stay on top of spending habits without additional effort.

The website also provides insightful analytics that break down your financial data into easy-to-understand visuals. These insights empower users to make informed decisions about saving money.

Another significant benefit is the community support available through forums and resources. Connecting with others who have similar goals can motivate and inspire new strategies for managing finances effectively.

With GoMyFinance.com, you’ll discover personalized suggestions tailored to your specific needs, making it easier than ever to reach those savings milestones.

Personalized Saving Plans

Personalized saving plans are a game changer for anyone looking to get their finances in order. At GoMyFinance.com, users can create tailored strategies that fit their unique goals and lifestyle.

You start by answering a few simple questions about your income, expenses, and financial aspirations. The platform then crafts a plan just for you. This means no more one-size-fits-all solutions that don’t quite resonate.

What sets these plans apart is the adaptability they offer. As life changes—whether it’s a new job or unexpected expenses—the system updates your savings strategy accordingly. You’ll always have an actionable roadmap.

Incorporating personal milestones like vacations or home purchases makes the process even more motivating. When saving aligns with what truly matters to you, reaching those targets becomes much easier and enjoyable.

Automated Savings and Budgeting Tools

Automated savings and budgeting tools are game-changers for anyone looking to take control of their finances. With GoMyFinance.com, these features work seamlessly in the background, allowing you to save without even thinking about it.

Setting up automated transfers into your savings account is a breeze. You can choose how much money to set aside each week or month. This hands-off approach means you’re less likely to be tempted to spend that cash on impulse buys.

Budgeting becomes effortless with real-time tracking of your expenses. The platform categorizes spending automatically, making it easier than ever to see where your money goes each month.

With alerts for upcoming bills and budget limits, you stay informed and on track. These intuitive tools help cultivate better financial habits while ensuring you never miss an opportunity to save more effectively.

Tips and Tricks for Maximizing Savings

To maximize your savings, start by setting clear financial goals. Whether it’s a dream vacation or an emergency fund, having a target makes saving more motivating.

Next, take advantage of automatic transfers. Set up your bank account to move funds into your savings automatically each month. This way, you save without even thinking about it.

Track your spending patterns using GoMyFinance.com’s budgeting tools. Identify areas where you can cut back—perhaps dining out less often or canceling unused subscriptions.

Utilize cashback apps and rewards programs when shopping. Every little bit adds up over time and contributes to your overall savings.

Remember that small changes in daily habits can lead to significant savings down the road. Switching off lights when not in use or packing lunch for work can make a difference in the long run.

Success Stories from Users

Users of GoMyFinance.com have shared inspiring stories that highlight the platform’s impact on their financial journeys. One user, Sarah, managed to save over $3,000 in just six months by adhering to her personalized savings plan. She was amazed at how simple adjustments could lead to significant savings.

Another user, Mike, found success through the automated budgeting tools offered by GoMyFinance.com. He reported a newfound clarity regarding his spending habits. With clear insights into his finances, he cut down unnecessary expenses and redirected those funds toward his goal of buying a new car.

Jessica’s story is particularly motivating; she turned her side hustle into a reality with the help of tailored saving strategies from GoMyFinance.com. By setting specific goals and using automated transfers, she reached her target faster than expected.

These real-life experiences demonstrate how practical and effective GoMyFinance.com can be for anyone looking to take control of their financial future.

Conclusion: Taking Control of Your Finances with GoMyFinance.com

Taking control of your finances is a journey that requires the right tools and resources. GoMyFinance.com offers an innovative approach to saving money effortlessly. With personalized saving plans, you can tailor your savings strategy to fit your lifestyle and goals. The automated savings and budgeting tools ensure that you stay on track without constant manual input.

As you explore tips and tricks for maximizing savings, you’ll discover methods that align with your spending habits. Many users have reported significant success through the platform, sharing stories of how GoMyFinance.com transformed their financial situation.

Embracing this user-friendly website means stepping into a world where managing your finances becomes simpler and more efficient. It’s time to harness these powerful features and take charge of your economic future with confidence.

FINANCE

Investiit.com Tips: Maximizing Your Investment Success

Investing is one of the most effective ways to grow your wealth over time and secure your financial future. However, without the right strategies and knowledge, it can feel overwhelming, especially with all the options available today. That’s where Investiit.com Tips comes in—offering expert guidance and actionable tips to help you make informed investment decisions and achieve success.

If you’re ready to take charge of your finances and maximize your returns, this guide will walk you through key tips and insights for smarter investing. Whether you’re a beginner or a seasoned investor, these tips will help you grow your portfolio with confidence.

Why Smart Investing Matters

Investing isn’t about luck—it’s about strategy. Whether you’re saving for retirement, building a college fund, or working toward financial independence, smart investing can:

- Increase Wealth Over Time through the power of compounding.

- Help You Beat Inflation, preserving your purchasing power.

- Provide Passive Income streams, freeing up your time for other pursuits.

Investiit.com Tips equips you with the tools and knowledge to make informed investment choices while minimizing risks.

Tip #1: Set Clear Financial Goals

Before you start investing, ask yourself this pivotal question—“What do I want to achieve financially?” Clear goals are the foundation of every successful investment strategy.

Actionable Steps:

- Write down your financial objectives. Examples include:

- Saving $50,000 for a house down payment in 5 years.

- Generating $2,000/month in passive income for retirement.

- Break your goals into short-term, medium-term, and long-term categories.

- Use Investiit.com’s goal calculator to better understand how much to invest and how often.

By clearly defining what you’re saving for, you’ll be more focused when picking investments.

Tip #2: Diversify, Diversify, Diversify

“You can’t put all your eggs in one basket.” This timeless advice applies perfectly to investing. Smart investors know that spreading their money across a range of asset classes and industries reduces risk while maximizing returns.

How to Diversify:

- Stocks: Invest in multiple industries (tech, healthcare, energy, etc.) or consider index funds for broad exposure.

- Bonds: Add stability to your portfolio by including government or corporate bonds.

- Real Estate: Look beyond physical properties—check out REITs (real estate investment trusts) for less hands-on investment.

- Alternative Investments: Explore precious metals, commodities, or even collectibles for unique diversification opportunities.

Check out Investiit.com Tips dedicated resources on stocks, bonds, and real estate for further tips.

Pro Tip: Diversifying internationally can also protect your portfolio from localized market downturns. Tools like ETFs make global investing easy and cost-effective.

Tip #3: Make Technology Your Ally

Investing in 2024 is no longer just about spreadsheets and in-person financial advisors. You have access to AI-driven tools, financial apps, and platforms that help you analyze potential investments, track your portfolio, and capitalize on timely opportunities.

Recommended Tools from Investiit.com Tips:

- Budgeting Apps to make room for increased investments.

- Stock Analysis Platforms for informed decisions (think advanced screeners).

- Robo-Advisors, manage your portfolio with algorithms to ensure your investments stay balanced and aligned with your goals.

Start exploring these apps, and you’ll feel more empowered with actionable insights right at your fingertips.

Tip #4: Watch Out for Fees

Investment fees might seem small at first glance, but over time, they can significantly cut into your returns. Paying attention to expense ratios, management fees, and trading commissions is crucial.

Key Tips:

- Stick to low-cost index funds or ETFs, which have much lower fees compared to actively managed funds.

- Research and compare brokerage platforms to find those offering zero-commission trading—many now compete for customers with lower costs.

- Choose a subscription-friendly investment platform like those highlighted on Investiit.com that keeps pricing transparent.

By keeping fees in check, you’ll retain a larger percentage of your gains over time.

Tip #5: Take Advantage of Tax Efficiency

Did you know that investing smartly isn’t just about picking the best stocks? It’s also about minimizing your tax liability. Tax efficiency plays a key role in helping you keep more of your hard-earned money.

Strategies to Consider:

- Use tax-advantaged accounts like IRAs, 401(k)s, or HSAs for long-term savings.

- Opt for tax-efficient investments, such as index funds and ETFs, that trigger fewer capital gains taxes.

- Harvest your losses strategically with tax-loss harvesting, where you can offset gains with losses from underperforming investments.

Dive into Investiit.com’s Taxes 101 for a complete guide on navigating tax-efficient investing.

Tip #6: Consistency Over Perfection

Perfect market timing is a myth that leads too many investors astray. Instead of trying to buy low and sell high, focus on consistency.

How to Stay Consistent:

- Set up automated contributions to your investment accounts. This “set it and forget it” approach builds your portfolio over time without stress.

- Make use of market dips to reinforce your investments (“buy the dip”). Major downturns often represent rare buying opportunities for long-term investors.

- Stick to your financial plan even during volatile periods.

Consistently investing over time, regardless of market fluctuations, allows you to take advantage of dollar-cost averaging and smooth out risks.

Remember: Consistency is a key driver behind financial success, not perfection.

Tip #7: Keep Learning and Stay Patient

Investing isn’t a one-time task; it’s an ongoing process of learning and adapting to new financial landscapes. Stay up to date with articles, webinars, and tools provided by platforms like Investiit.com Tips.

Patience is equally important. Remember Warren Buffett’s golden rule: “The stock market is a device for transferring money from the impatient to the patient.”

Cultivate the discipline to stay invested for the long run, and your returns will likely outpace any short-term turbulence.

Take the First Step Toward Investment Success

Investing can seem complex, but with the right guidance, tools, and mindset, anyone can succeed. Whether you’re exploring stocks, real estate, or retirement strategies, the fundamentals remain the same—with discipline, diversification, and clear goals, you’ll see your efforts pay off.

Investiit.com Tips is here to support you every step of the way. Browse resources tailored for investors, join our community for tips and discussions, and use our calculators to make smarter decisions today.

FINANCE

Quantum Encryption: The Future of Securing Data

Data breaches are becoming alarmingly common. Almost daily, we hear stories of compromised personal information, financial data leaks, and unauthorized access to sensitive records. Traditional encryption methods, while currently effective, may soon fail to keep up with the rapid advancements in computational power, particularly with the rise of quantum encryption computing.

Enter quantum encryption—a revolutionary technology poised to transform the way we secure data. But what is quantum , and why is it the future of secure communication?

This blog will explore the fundamentals of quantum, how it differs from classical encryption, its applications, and why it’s considered the gold standard for future-proofing data.

What is Quantum Encryption?

Quantum encryption, often referred to as quantum key distribution (QKD), leverages the principles of quantum mechanics to secure data. At its core is the idea of encoding information into quantum states, typically photons, to create unbreakable encryption keys.

The defining feature of QKD is its absolute security, rooted in the laws of physics rather than computational complexity. If a third party attempts to intercept or measure the quantum state, the act of observing it irreversibly alters the data, alerting both the sender and the recipient of a potential breach.

Key Principles of Quantum Encryption

- Quantum Superposition: A quantum particle, like a photon, can exist in multiple states simultaneously. This allows information to be encoded in various quantum states.

- Quantum Entanglement: Two particles can be linked, so the state of one particle is instantly reflected in the other, even over vast distances.

- Heisenberg’s Uncertainty Principle: Observing or measuring a quantum state alters its original properties, making unauthorized interception detectable.

How Quantum Encryption Differs from Classical Encryption

Classical encryption relies on mathematical algorithms to scramble data, such as RSA or AES encryption. While highly secure today, these methods depend on the computational limitations of existing machines. Powerful quantum computers, however, could potentially solve these algorithms much faster through brute force, rendering most classical encryption vulnerable.

Quantum bypasses this risk by offering a fundamentally secure method. Unlike classical methods, quantum encryption isn’t about making it difficult to crack the code—it’s about making it impossible.

Why is Quantum Encryption Important?

The increasing capability of quantum computers poses a significant threat to traditional cybersecurity frameworks. Here’s why quantum is crucial for future-proofing data security:

1. Protection Against Quantum Computing Threats

Large-scale quantum computers, once operational, will have the ability to break existing encryption protocols rapidly. Quantum provides a safeguard against these advancements, ensuring communications remain secure even in a post-quantum world.

2. Secure Sensitive Communications

For industries like defense, finance, and healthcare, a single data breach could have devastating consequences. Quantum encryption ensures sensitive communication channels are almost entirely impenetrable.

3. Maintaining Trust in Digital Transactions

Digital commerce relies heavily on secure financial transactions. Quantum provides robust protection to maintain user trust and prevent fraud.

Current Applications of Quantum Encryption

While quantum encryption may sound futuristic, it’s already being tested and implemented across various sectors.

1. Government and Defense

Nation-states globally recognize the geopolitical importance of quantum . Governments are investing heavily in quantum key distribution to secure communications between intelligence agencies and military organizations.

2. Financial Institutions

Banks and financial institutions are at the forefront of adopting quantum-safe encryption. With sensitive information at stake, the financial industry is pushing for encryption methods that quantum computers cannot crack.

3. Healthcare and Pharmaceuticals

The protection of medical data and intellectual property, such as drug formulations, necessitates highly secure encryption methods. Quantum offers unmatched security for this sensitive data.

4. Telecommunications

Major communication companies are testing QKD networks to ensure communication lines remain secure as technologies evolve.

5. Research and Data Transmission

Quantum encryption is being used in scientific research to securely share data across global teams.

The Challenges of Quantum Encryption

Despite its incredible promise, quantum isn’t without challenges.

1. Expensive Infrastructure

Implementing QKD requires specialized equipment such as quantum processors, which can be prohibitively expensive. Fiber optic lines and quantum-enabled satellites further add to the cost.

2. Scalability Issues

Quantum works well for point-to-point communication but scaling it for large networks is an ongoing technical hurdle.

3. Distance Limitations

Photons carrying quantum information degrade over long distances, creating potential issues for global communication without intermediary nodes.

4. Integration with Existing Networks

Integrating QKD with current encryption systems and network infrastructure requires significant technical expertise and investment.

Looking Ahead: The Future of Quantum Encryption

Quantum encryption is still in its early stages but advancements in research, technology, and cost-efficiency indicate a bright future. Some of the major developments we can anticipate include:

1. Quantum-Secured Satellites

Projects like China’s Micius satellite, designed for quantum communication, show significant promise in globalizing QKD. Similar satellite-based systems may become the backbone of secure international communications.

2. Fiber Optic Networks

Widespread deployment of quantum-ready fiber optic networks could support shorter-range QKD systems on a broader scale, allowing secure communication within cities and regions.

3. Hybrid Models Combining Classical and Quantum Encryption

Enterprises may adopt hybrid encryption models where QKD is used to distribute encryption keys, while classical methods are used to encrypt bulk data.

Quantum Encryption and Cybersecurity: Are You Prepared?

The rise of quantum computing may render current encryption protocols obsolete, but technologies like quantum provide an opportunity to stay ahead of the curve. Whether you’re securing financial transactions, sensitive organizational data, or government communications, quantum encryption is shaping up to be a crucial tool for tomorrow’s cybersecurity.

While full-scale implementation of quantum remains a challenge today, the technology’s potential is undeniable. Now is the time for businesses, governments, and innovators to invest in quantum research and infrastructure to prepare for the next era of secure communication.

Call to Action

Organizations and governments must act swiftly to understand, invest in, and adopt quantum technologies. Collaboration across industries, academic institutions, and international borders will be essential to effectively develop global quantum-secure frameworks. Education and training in quantum cryptography will also play a critical role in building the expertise necessary to implement these advanced systems.

As quantum computing continues to advance at an unprecedented pace, the roadmap to quantum must be treated as an urgent priority. Those who take proactive steps today will not only secure their data but also gain a significant competitive and strategic advantage in the data-driven world of tomorrow.

Key Takeaways

Quantum encryption is no longer a concept confined to theoretical research; it is steadily transitioning into practical application, with immense implications for cybersecurity and data protection. Industries that handle sensitive data—such as government, finance, healthcare, and telecommunications—are already exploring its potential to safeguard critical information.

However, adopting quantum comes with its share of challenges. High implementation costs, scalability issues, and integration complexities must be addressed to unlock its full potential. Governments, businesses, and academic institutions must collaborate to overcome these hurdles and create a more secure digital landscape.

The rise of quantum computing underscores the urgency of transitioning to quantum-safe systems. Traditional encryption protocols face obsolescence in the quantum era, making the strategic adoption of quantum a proactive defense against future cyber threats. Now is the time to act, ensuring that organizations are prepared for the new reality of cybersecurity.

By prioritizing research, infrastructure development, and education in quantum technologies, society can unlock secure communication channels that are resilient against even the most advanced threats. The road to a secure digital future begins today, with quantum serving as a vital part of that journey.

FINANCE

Understanding the CEDA Zero Income Affidavit: A Comprehensive Guide

In Botswana, the Citizen Entrepreneurial Development Agency CEDA Zero Income Affidavit plays a pivotal role in fostering economic growth by supporting entrepreneurs and small businesses. A critical component of accessing CEDA’s programs is the **Zero Income Affidavit**, a legal document verifying an individual’s lack of income. This guide demystifies the affidavit, outlining its purpose, application process, and common pitfalls, ensuring you navigate CEDA’s requirements with confidence.

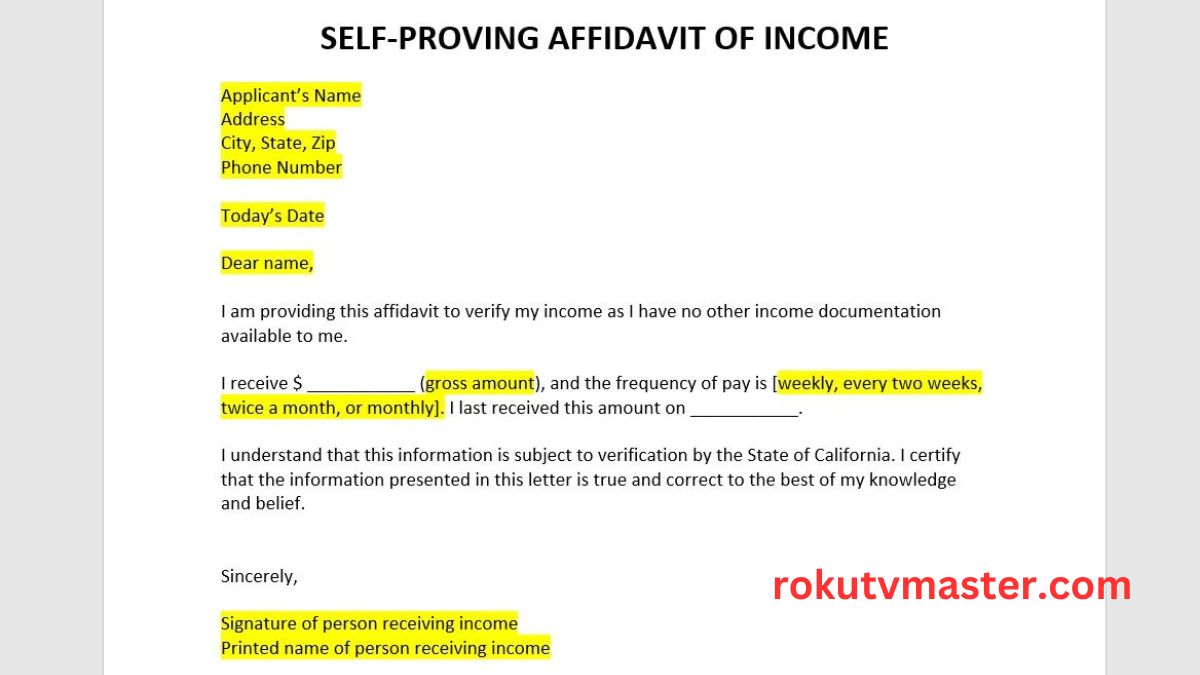

What is the CEDA Zero Income Affidavit?

The CEDA Zero Income Affidavit is a sworn statement declaring that an individual has no income from employment, business, or other sources. Legally binding under Botswana’s *Oaths and Affidavits Act*, it must be notarized by a commissioner of oaths or legal professional. This document serves as official proof of income status, often required for eligibility in CEDA’s initiatives aimed at economically vulnerable groups.

Purpose of the Affidavit

CEDA mandates this affidavit to ensure resources are allocated to those genuinely in need. By verifying zero income, CEDA mitigates fraud risks and prioritizes support for entrepreneurs, students, or individuals seeking social programs. It acts as a gateway to loans, grants, and training opportunities, empowering beneficiaries to pursue economic stability.

Who Needs a CEDA Zero Income Affidavit?

1. Entrepreneurs:

Startups or small businesses without revenue streams applying for CEDA funding.

2. Students:

Those seeking scholarships or grants requiring financial need verification.

3. Social Program Applicants:

Individuals accessing government aid or NGO support.

How to Obtain the Affidavit

1. Acquire the Form:

Available at CEDA offices, magistrates’ courts, or online via Botswana’s government portals.

2. Complete the Document:

Provide personal details (name, ID, address) and declare zero income.

3. Notarization:

Sign the affidavit in the presence of a commissioner of oaths, who verifies your identity and witnesses the signature.

4. Submission:

Submit the notarized affidavit to CEDA or the relevant institution.

Step-by-Step Guide

1. Visit a CEDA Office or Website:

Download the form or collect it in person.

2. Fill Out Accurately:

Use black ink; avoid errors. Double-check personal information.

3. Prepare for Notarization:

Bring a valid ID (e.g., passport, Omang). Fees for notarization vary (typically BWP 50–100).

4. Submit with Supporting Documents:

Some cases may require bank statements or unemployment letters.

Common Mistakes to Avoid Incorrect Information:

Discrepancies between the affidavit and other documents can lead to rejection.

Skipping Notarization:

An unsigned/unnotarized affidavit is invalid.

Misuse:

Using it for non-CEDA purposes (e.g., loan applications) may not be accepted.

Expired Affidavits:

Update if your financial status changes; affidavits may have validity periods.

FAQs

1. How long is the affidavit valid?

Typically 3–6 months; confirm with CEDA for specific programs.

2. What if I lie on the affidavit?

False statements constitute perjury, punishable by fines or imprisonment.

3. Can I use it outside Botswana?

Generally for domestic use; check with international institutions for acceptance.

4. Alternatives if unavailable?

Provide bank statements, unemployment letters, or tax returns as proof.

Conclusion

The CEDA Zero Income Affidavit is a vital tool for accessing opportunities in Botswana. By understanding its requirements and adhering to legal protocols, applicants can efficiently secure support. Always ensure accuracy, stay informed about updates, and consult CEDA’s official resources or legal advisors for guidance. Through transparency and diligence, this document becomes a stepping stone toward financial empowerment and growth.

-

TECH10 months ago

TECH10 months agoExploring Precision Technologies International: The Future of Advanced Engineering

-

TECH10 months ago

TECH10 months agoStevens Institute of Technology: Pioneering Innovation and Excellence in Education

-

NEWS9 months ago

NEWS9 months agoThe NYT’s Take on British Affairs: A Comprehensive Review

-

FINANCE8 months ago

FINANCE8 months agoInvestiit.com Tips: Maximizing Your Investment Success

-

HEALTH9 months ago

HEALTH9 months agoThe Ultimate Guide to Physical Therapy Web Design That Converts

-

NEWS3 months ago

NEWS3 months agoTop 5 Reasons to Follow UKOBIW.com for Your Daily News Fix

-

HEALTH9 months ago

HEALTH9 months agoThe Allure of Candy Red: A Bold Hue That Never Goes Out of Style

-

CROSSWORD & PUZZLES6 months ago

CROSSWORD & PUZZLES6 months agoVault Opener NYT Crossword: An Informative Guide