FINANCE

Unlocking Potential: How Thruster Finance is Revolutionizing DeFi

Decentralized Finance, or DeFi, has taken the financial world by storm. It’s a space where traditional barriers are dismantled and innovation reigns supreme. Imagine a system that enables peer-to-peer transactions without intermediaries, offering unprecedented access to financial services for everyone. Sounds exciting, right? However, with this rapid growth comes its fair share of challenges—security risks, scalability issues, and user experience hurdles.

Amidst this evolving landscape emerges Thruster Finance—a platform determined to tackle these obstacles head-on. In an age where speed and efficiency are paramount in finance, Thruster Finance is not just another player; it’s a game-changer. Let’s dive deeper into how it’s revolutionizing the DeFi ecosystem and unlocking new potential for investors and borrowers alike.

The Growth of DeFi and its Challenges

Decentralized Finance, or DeFi, has experienced explosive growth over the last few years. From lending to trading, it offers a range of financial services without traditional banking institutions. This expansion is fueled by innovations like smart contracts and blockchain technology.

However, rapid growth brings challenges. Scalability issues often lead to network congestion and high transaction fees. Users face hurdles in navigating complex interfaces that can be intimidating for newcomers.

Security remains a pressing concern with hacks and scams frequently making headlines. Regulatory uncertainty adds another layer of complexity as governments scramble to catch up with this fast-evolving landscape.

Despite these obstacles, the demand for decentralized solutions continues to rise as users seek autonomy over their finances. The potential for greater inclusivity drives further exploration in this dynamic space.

What is Thruster Finance?

Thruster Finance is an innovative platform designed to enhance the decentralized finance (DeFi) landscape. It offers a unique approach to borrowing and lending in the crypto space.

At its core, Thruster Finance aims to simplify transactions while providing robust security features. Users can engage in financial activities without relying on traditional banks or intermediaries.

The platform leverages blockchain technology for transparency and efficiency. This ensures that all processes are visible and verifiable, boosting user trust.

Moreover, Thruster Finance incorporates smart contracts. These self-executing agreements automate key functions, reducing delays and potential errors associated with manual handling.

With a mission to unlock greater opportunities for users, Thruster seeks to empower both investors and borrowers alike within the DeFi ecosystem. Its innovative solutions are set to reshape how users interact with digital assets.

How Thruster Finance is Solving the Problems in DeFi

Thruster Finance is stepping up to tackle the pressing issues in the DeFi space. One of its primary focuses is reducing transaction costs, which can be a barrier for many users. By optimizing blockchain processes, Thruster enhances efficiency and lowers fees.

Security remains a top concern in decentralized finance. Thruster Finance employs advanced cryptographic protocols and smart contract audits to safeguard user assets against vulnerabilities. This commitment builds trust within the community.

Additionally, Thruster addresses liquidity challenges through innovative solutions that attract more participants into its ecosystem. By incentivizing both investors and borrowers, it creates a dynamic marketplace where capital flows freely.

User experience also gets attention at Thruster Finance. With an intuitive interface and streamlined processes, even newcomers can navigate DeFi effortlessly without feeling overwhelmed by complexity or jargon.

Key Features of Thruster Finance

Thruster Finance stands out with its unique blend of features designed for both investors and borrowers. One key aspect is its user-friendly interface, which simplifies complex financial transactions. This accessibility opens the doors to DeFi for a wider audience.

Another notable feature is the robust security protocols in place. Thruster Finance employs advanced encryption methods, ensuring that users’ assets remain safe from potential threats.

The platform also offers competitive interest rates, making it an attractive option for those looking to lend or borrow funds. These appealing rates are coupled with flexible repayment options, catering to varying user needs.

Moreover, Thruster Finance integrates seamlessly with various cryptocurrency wallets. This interoperability enhances convenience and broadens access to different digital assets within the ecosystem.

Community-driven governance through decentralized voting empowers users to have a say in future developments. This fosters trust and engagement among participants.

The Benefits of Using Thruster Finance for Investors and Borrowers

Thruster Finance offers unique advantages for both investors and borrowers. For investors, it provides access to a transparent marketplace with diverse asset options. This flexibility allows users to diversify their portfolios while minimizing risk.

Borrowers benefit from competitive interest rates that are often lower than traditional financial institutions. The decentralized nature ensures faster transactions without cumbersome paperwork, streamlining the borrowing process significantly.

Security is another major plus. Thruster Finance employs advanced protocols to protect user assets against potential threats. This builds trust within the community and encourages more participants.

Moreover, users can leverage their crypto holdings effectively, enabling them to capitalize on market opportunities rather than letting their assets sit idle.

The platform fosters an environment of collaboration, encouraging innovation in lending practices that ultimately benefits all participants involved in the ecosystem.

Future Plans for Thruster Finance and the Future of DeFi

Thruster Finance is gearing up for an exciting future. The team aims to expand its platform by incorporating cross-chain capabilities. This will allow users from different blockchain ecosystems to interact seamlessly.

In addition, plans include launching educational resources tailored for new investors and borrowers. Empowering users with knowledge can enhance their experience within the DeFi space.

The roadmap also highlights partnerships with other DeFi projects. Collaborations can lead to innovative solutions that address existing challenges.

As Thruster Finance evolves, it remains committed to community engagement. Feedback loops will become more robust, ensuring user needs shape future developments.

This proactive approach positions Thruster Finance as a key player in the expanding DeFi landscape, ready to adapt and thrive amidst industry changes.

Conclusion

The rise of decentralized finance has brought about significant transformations in how we think about, access, and utilize financial services. Thruster Finance stands at the forefront of this movement, addressing many challenges that have hindered broader adoption. With its innovative solutions and user-centric features, it is paving the way for a more accessible and efficient DeFi ecosystem.

As both investors and borrowers look for reliable platforms to engage with digital assets, Thruster Finance offers unparalleled opportunities to maximize their potential. Its commitment to enhancing security while providing liquidity makes it a game-changer in the ever-evolving landscape of finance.

Looking ahead, Thruster Finance is poised not just to grow but also to redefine what’s possible within DeFi. This evolution promises exciting advancements that can benefit everyone involved—from seasoned investors seeking new avenues for wealth creation to newcomers eager to explore decentralized options.

FINANCE

Investiit.com Tips: Maximizing Your Investment Success

Investing is one of the most effective ways to grow your wealth over time and secure your financial future. However, without the right strategies and knowledge, it can feel overwhelming, especially with all the options available today. That’s where Investiit.com Tips comes in—offering expert guidance and actionable tips to help you make informed investment decisions and achieve success.

If you’re ready to take charge of your finances and maximize your returns, this guide will walk you through key tips and insights for smarter investing. Whether you’re a beginner or a seasoned investor, these tips will help you grow your portfolio with confidence.

Why Smart Investing Matters

Investing isn’t about luck—it’s about strategy. Whether you’re saving for retirement, building a college fund, or working toward financial independence, smart investing can:

- Increase Wealth Over Time through the power of compounding.

- Help You Beat Inflation, preserving your purchasing power.

- Provide Passive Income streams, freeing up your time for other pursuits.

Investiit.com Tips equips you with the tools and knowledge to make informed investment choices while minimizing risks.

Tip #1: Set Clear Financial Goals

Before you start investing, ask yourself this pivotal question—“What do I want to achieve financially?” Clear goals are the foundation of every successful investment strategy.

Actionable Steps:

- Write down your financial objectives. Examples include:

- Saving $50,000 for a house down payment in 5 years.

- Generating $2,000/month in passive income for retirement.

- Break your goals into short-term, medium-term, and long-term categories.

- Use Investiit.com’s goal calculator to better understand how much to invest and how often.

By clearly defining what you’re saving for, you’ll be more focused when picking investments.

Tip #2: Diversify, Diversify, Diversify

“You can’t put all your eggs in one basket.” This timeless advice applies perfectly to investing. Smart investors know that spreading their money across a range of asset classes and industries reduces risk while maximizing returns.

How to Diversify:

- Stocks: Invest in multiple industries (tech, healthcare, energy, etc.) or consider index funds for broad exposure.

- Bonds: Add stability to your portfolio by including government or corporate bonds.

- Real Estate: Look beyond physical properties—check out REITs (real estate investment trusts) for less hands-on investment.

- Alternative Investments: Explore precious metals, commodities, or even collectibles for unique diversification opportunities.

Check out Investiit.com Tips dedicated resources on stocks, bonds, and real estate for further tips.

Pro Tip: Diversifying internationally can also protect your portfolio from localized market downturns. Tools like ETFs make global investing easy and cost-effective.

Tip #3: Make Technology Your Ally

Investing in 2024 is no longer just about spreadsheets and in-person financial advisors. You have access to AI-driven tools, financial apps, and platforms that help you analyze potential investments, track your portfolio, and capitalize on timely opportunities.

Recommended Tools from Investiit.com Tips:

- Budgeting Apps to make room for increased investments.

- Stock Analysis Platforms for informed decisions (think advanced screeners).

- Robo-Advisors, manage your portfolio with algorithms to ensure your investments stay balanced and aligned with your goals.

Start exploring these apps, and you’ll feel more empowered with actionable insights right at your fingertips.

Tip #4: Watch Out for Fees

Investment fees might seem small at first glance, but over time, they can significantly cut into your returns. Paying attention to expense ratios, management fees, and trading commissions is crucial.

Key Tips:

- Stick to low-cost index funds or ETFs, which have much lower fees compared to actively managed funds.

- Research and compare brokerage platforms to find those offering zero-commission trading—many now compete for customers with lower costs.

- Choose a subscription-friendly investment platform like those highlighted on Investiit.com that keeps pricing transparent.

By keeping fees in check, you’ll retain a larger percentage of your gains over time.

Tip #5: Take Advantage of Tax Efficiency

Did you know that investing smartly isn’t just about picking the best stocks? It’s also about minimizing your tax liability. Tax efficiency plays a key role in helping you keep more of your hard-earned money.

Strategies to Consider:

- Use tax-advantaged accounts like IRAs, 401(k)s, or HSAs for long-term savings.

- Opt for tax-efficient investments, such as index funds and ETFs, that trigger fewer capital gains taxes.

- Harvest your losses strategically with tax-loss harvesting, where you can offset gains with losses from underperforming investments.

Dive into Investiit.com’s Taxes 101 for a complete guide on navigating tax-efficient investing.

Tip #6: Consistency Over Perfection

Perfect market timing is a myth that leads too many investors astray. Instead of trying to buy low and sell high, focus on consistency.

How to Stay Consistent:

- Set up automated contributions to your investment accounts. This “set it and forget it” approach builds your portfolio over time without stress.

- Make use of market dips to reinforce your investments (“buy the dip”). Major downturns often represent rare buying opportunities for long-term investors.

- Stick to your financial plan even during volatile periods.

Consistently investing over time, regardless of market fluctuations, allows you to take advantage of dollar-cost averaging and smooth out risks.

Remember: Consistency is a key driver behind financial success, not perfection.

Tip #7: Keep Learning and Stay Patient

Investing isn’t a one-time task; it’s an ongoing process of learning and adapting to new financial landscapes. Stay up to date with articles, webinars, and tools provided by platforms like Investiit.com Tips.

Patience is equally important. Remember Warren Buffett’s golden rule: “The stock market is a device for transferring money from the impatient to the patient.”

Cultivate the discipline to stay invested for the long run, and your returns will likely outpace any short-term turbulence.

Take the First Step Toward Investment Success

Investing can seem complex, but with the right guidance, tools, and mindset, anyone can succeed. Whether you’re exploring stocks, real estate, or retirement strategies, the fundamentals remain the same—with discipline, diversification, and clear goals, you’ll see your efforts pay off.

Investiit.com Tips is here to support you every step of the way. Browse resources tailored for investors, join our community for tips and discussions, and use our calculators to make smarter decisions today.

FINANCE

Quantum Encryption: The Future of Securing Data

Data breaches are becoming alarmingly common. Almost daily, we hear stories of compromised personal information, financial data leaks, and unauthorized access to sensitive records. Traditional encryption methods, while currently effective, may soon fail to keep up with the rapid advancements in computational power, particularly with the rise of quantum encryption computing.

Enter quantum encryption—a revolutionary technology poised to transform the way we secure data. But what is quantum , and why is it the future of secure communication?

This blog will explore the fundamentals of quantum, how it differs from classical encryption, its applications, and why it’s considered the gold standard for future-proofing data.

What is Quantum Encryption?

Quantum encryption, often referred to as quantum key distribution (QKD), leverages the principles of quantum mechanics to secure data. At its core is the idea of encoding information into quantum states, typically photons, to create unbreakable encryption keys.

The defining feature of QKD is its absolute security, rooted in the laws of physics rather than computational complexity. If a third party attempts to intercept or measure the quantum state, the act of observing it irreversibly alters the data, alerting both the sender and the recipient of a potential breach.

Key Principles of Quantum Encryption

- Quantum Superposition: A quantum particle, like a photon, can exist in multiple states simultaneously. This allows information to be encoded in various quantum states.

- Quantum Entanglement: Two particles can be linked, so the state of one particle is instantly reflected in the other, even over vast distances.

- Heisenberg’s Uncertainty Principle: Observing or measuring a quantum state alters its original properties, making unauthorized interception detectable.

How Quantum Encryption Differs from Classical Encryption

Classical encryption relies on mathematical algorithms to scramble data, such as RSA or AES encryption. While highly secure today, these methods depend on the computational limitations of existing machines. Powerful quantum computers, however, could potentially solve these algorithms much faster through brute force, rendering most classical encryption vulnerable.

Quantum bypasses this risk by offering a fundamentally secure method. Unlike classical methods, quantum encryption isn’t about making it difficult to crack the code—it’s about making it impossible.

Why is Quantum Encryption Important?

The increasing capability of quantum computers poses a significant threat to traditional cybersecurity frameworks. Here’s why quantum is crucial for future-proofing data security:

1. Protection Against Quantum Computing Threats

Large-scale quantum computers, once operational, will have the ability to break existing encryption protocols rapidly. Quantum provides a safeguard against these advancements, ensuring communications remain secure even in a post-quantum world.

2. Secure Sensitive Communications

For industries like defense, finance, and healthcare, a single data breach could have devastating consequences. Quantum encryption ensures sensitive communication channels are almost entirely impenetrable.

3. Maintaining Trust in Digital Transactions

Digital commerce relies heavily on secure financial transactions. Quantum provides robust protection to maintain user trust and prevent fraud.

Current Applications of Quantum Encryption

While quantum encryption may sound futuristic, it’s already being tested and implemented across various sectors.

1. Government and Defense

Nation-states globally recognize the geopolitical importance of quantum . Governments are investing heavily in quantum key distribution to secure communications between intelligence agencies and military organizations.

2. Financial Institutions

Banks and financial institutions are at the forefront of adopting quantum-safe encryption. With sensitive information at stake, the financial industry is pushing for encryption methods that quantum computers cannot crack.

3. Healthcare and Pharmaceuticals

The protection of medical data and intellectual property, such as drug formulations, necessitates highly secure encryption methods. Quantum offers unmatched security for this sensitive data.

4. Telecommunications

Major communication companies are testing QKD networks to ensure communication lines remain secure as technologies evolve.

5. Research and Data Transmission

Quantum encryption is being used in scientific research to securely share data across global teams.

The Challenges of Quantum Encryption

Despite its incredible promise, quantum isn’t without challenges.

1. Expensive Infrastructure

Implementing QKD requires specialized equipment such as quantum processors, which can be prohibitively expensive. Fiber optic lines and quantum-enabled satellites further add to the cost.

2. Scalability Issues

Quantum works well for point-to-point communication but scaling it for large networks is an ongoing technical hurdle.

3. Distance Limitations

Photons carrying quantum information degrade over long distances, creating potential issues for global communication without intermediary nodes.

4. Integration with Existing Networks

Integrating QKD with current encryption systems and network infrastructure requires significant technical expertise and investment.

Looking Ahead: The Future of Quantum Encryption

Quantum encryption is still in its early stages but advancements in research, technology, and cost-efficiency indicate a bright future. Some of the major developments we can anticipate include:

1. Quantum-Secured Satellites

Projects like China’s Micius satellite, designed for quantum communication, show significant promise in globalizing QKD. Similar satellite-based systems may become the backbone of secure international communications.

2. Fiber Optic Networks

Widespread deployment of quantum-ready fiber optic networks could support shorter-range QKD systems on a broader scale, allowing secure communication within cities and regions.

3. Hybrid Models Combining Classical and Quantum Encryption

Enterprises may adopt hybrid encryption models where QKD is used to distribute encryption keys, while classical methods are used to encrypt bulk data.

Quantum Encryption and Cybersecurity: Are You Prepared?

The rise of quantum computing may render current encryption protocols obsolete, but technologies like quantum provide an opportunity to stay ahead of the curve. Whether you’re securing financial transactions, sensitive organizational data, or government communications, quantum encryption is shaping up to be a crucial tool for tomorrow’s cybersecurity.

While full-scale implementation of quantum remains a challenge today, the technology’s potential is undeniable. Now is the time for businesses, governments, and innovators to invest in quantum research and infrastructure to prepare for the next era of secure communication.

Call to Action

Organizations and governments must act swiftly to understand, invest in, and adopt quantum technologies. Collaboration across industries, academic institutions, and international borders will be essential to effectively develop global quantum-secure frameworks. Education and training in quantum cryptography will also play a critical role in building the expertise necessary to implement these advanced systems.

As quantum computing continues to advance at an unprecedented pace, the roadmap to quantum must be treated as an urgent priority. Those who take proactive steps today will not only secure their data but also gain a significant competitive and strategic advantage in the data-driven world of tomorrow.

Key Takeaways

Quantum encryption is no longer a concept confined to theoretical research; it is steadily transitioning into practical application, with immense implications for cybersecurity and data protection. Industries that handle sensitive data—such as government, finance, healthcare, and telecommunications—are already exploring its potential to safeguard critical information.

However, adopting quantum comes with its share of challenges. High implementation costs, scalability issues, and integration complexities must be addressed to unlock its full potential. Governments, businesses, and academic institutions must collaborate to overcome these hurdles and create a more secure digital landscape.

The rise of quantum computing underscores the urgency of transitioning to quantum-safe systems. Traditional encryption protocols face obsolescence in the quantum era, making the strategic adoption of quantum a proactive defense against future cyber threats. Now is the time to act, ensuring that organizations are prepared for the new reality of cybersecurity.

By prioritizing research, infrastructure development, and education in quantum technologies, society can unlock secure communication channels that are resilient against even the most advanced threats. The road to a secure digital future begins today, with quantum serving as a vital part of that journey.

FINANCE

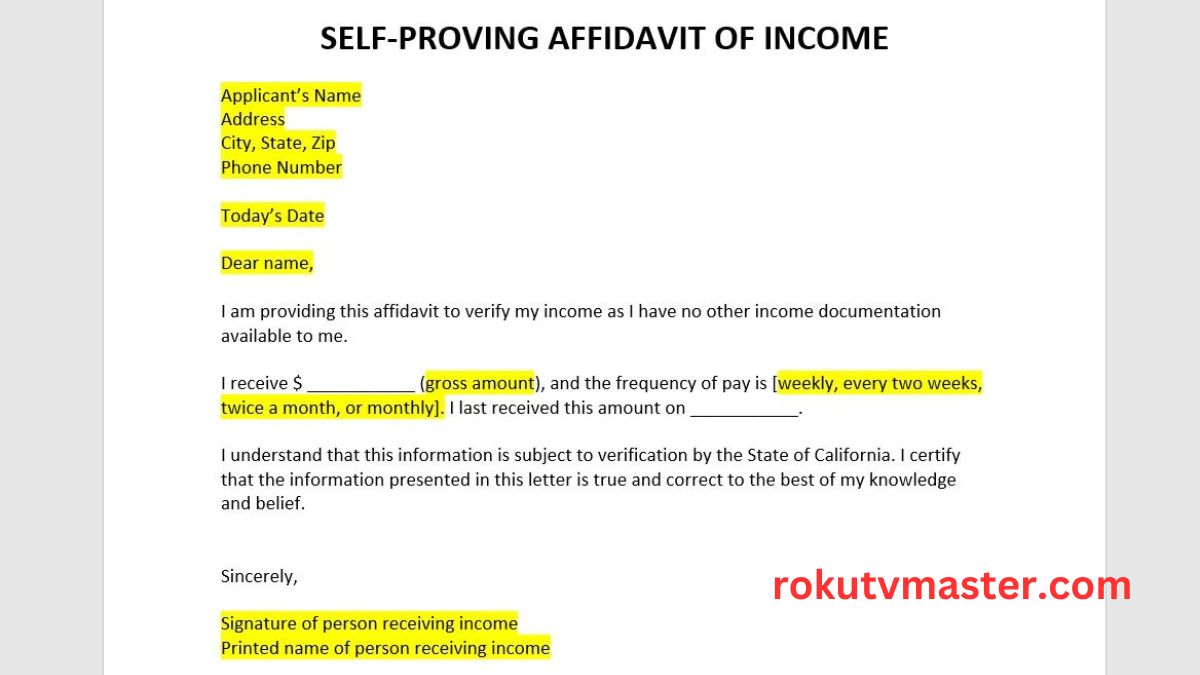

Understanding the CEDA Zero Income Affidavit: A Comprehensive Guide

In Botswana, the Citizen Entrepreneurial Development Agency CEDA Zero Income Affidavit plays a pivotal role in fostering economic growth by supporting entrepreneurs and small businesses. A critical component of accessing CEDA’s programs is the **Zero Income Affidavit**, a legal document verifying an individual’s lack of income. This guide demystifies the affidavit, outlining its purpose, application process, and common pitfalls, ensuring you navigate CEDA’s requirements with confidence.

What is the CEDA Zero Income Affidavit?

The CEDA Zero Income Affidavit is a sworn statement declaring that an individual has no income from employment, business, or other sources. Legally binding under Botswana’s *Oaths and Affidavits Act*, it must be notarized by a commissioner of oaths or legal professional. This document serves as official proof of income status, often required for eligibility in CEDA’s initiatives aimed at economically vulnerable groups.

Purpose of the Affidavit

CEDA mandates this affidavit to ensure resources are allocated to those genuinely in need. By verifying zero income, CEDA mitigates fraud risks and prioritizes support for entrepreneurs, students, or individuals seeking social programs. It acts as a gateway to loans, grants, and training opportunities, empowering beneficiaries to pursue economic stability.

Who Needs a CEDA Zero Income Affidavit?

1. Entrepreneurs:

Startups or small businesses without revenue streams applying for CEDA funding.

2. Students:

Those seeking scholarships or grants requiring financial need verification.

3. Social Program Applicants:

Individuals accessing government aid or NGO support.

How to Obtain the Affidavit

1. Acquire the Form:

Available at CEDA offices, magistrates’ courts, or online via Botswana’s government portals.

2. Complete the Document:

Provide personal details (name, ID, address) and declare zero income.

3. Notarization:

Sign the affidavit in the presence of a commissioner of oaths, who verifies your identity and witnesses the signature.

4. Submission:

Submit the notarized affidavit to CEDA or the relevant institution.

Step-by-Step Guide

1. Visit a CEDA Office or Website:

Download the form or collect it in person.

2. Fill Out Accurately:

Use black ink; avoid errors. Double-check personal information.

3. Prepare for Notarization:

Bring a valid ID (e.g., passport, Omang). Fees for notarization vary (typically BWP 50–100).

4. Submit with Supporting Documents:

Some cases may require bank statements or unemployment letters.

Common Mistakes to Avoid Incorrect Information:

Discrepancies between the affidavit and other documents can lead to rejection.

Skipping Notarization:

An unsigned/unnotarized affidavit is invalid.

Misuse:

Using it for non-CEDA purposes (e.g., loan applications) may not be accepted.

Expired Affidavits:

Update if your financial status changes; affidavits may have validity periods.

FAQs

1. How long is the affidavit valid?

Typically 3–6 months; confirm with CEDA for specific programs.

2. What if I lie on the affidavit?

False statements constitute perjury, punishable by fines or imprisonment.

3. Can I use it outside Botswana?

Generally for domestic use; check with international institutions for acceptance.

4. Alternatives if unavailable?

Provide bank statements, unemployment letters, or tax returns as proof.

Conclusion

The CEDA Zero Income Affidavit is a vital tool for accessing opportunities in Botswana. By understanding its requirements and adhering to legal protocols, applicants can efficiently secure support. Always ensure accuracy, stay informed about updates, and consult CEDA’s official resources or legal advisors for guidance. Through transparency and diligence, this document becomes a stepping stone toward financial empowerment and growth.

-

TECH9 months ago

TECH9 months agoExploring Precision Technologies International: The Future of Advanced Engineering

-

TECH9 months ago

TECH9 months agoStevens Institute of Technology: Pioneering Innovation and Excellence in Education

-

NEWS9 months ago

NEWS9 months agoThe NYT’s Take on British Affairs: A Comprehensive Review

-

FINANCE8 months ago

FINANCE8 months agoInvestiit.com Tips: Maximizing Your Investment Success

-

HEALTH9 months ago

HEALTH9 months agoThe Ultimate Guide to Physical Therapy Web Design That Converts

-

NEWS3 months ago

NEWS3 months agoTop 5 Reasons to Follow UKOBIW.com for Your Daily News Fix

-

CROSSWORD & PUZZLES6 months ago

CROSSWORD & PUZZLES6 months agoVault Opener NYT Crossword: An Informative Guide

-

HEALTH9 months ago

HEALTH9 months agoThe Allure of Candy Red: A Bold Hue That Never Goes Out of Style